INNOVATING THE CRYPTO CURRENCY WORLD

The First Licensed and Regulated Tokenized Crypto Currency Exchange & Index Fund based in the US

Pre-IPO Testing the Waters Phase is Live, 20% bonus ends in:

1 BLV = $1 USD

What is BlockVest?

Blockvest uses blockchain technology, digital identity, and digitize assets that are self-managed with smart contracts, to achieve a “smart economy” on a distributed network.

Blockvest (BLV) is an ERC20 token based upon the Ethereum blockchain. Operating on the blockchain allows for global accessibility, 24/7 trading, transparency, public verification of Blockvest’s holdings and no expensive legacy banking fees. Blockvest Nvestnodes generate passive income through asset backed profit sharing smart contracts. At it’s core, BLV is a security token that’s representative of the top performing cryptocurrency index. The initial tokens can only be acquired during the Initial Coin Offering (ICO) which is a one off, closed-cap offering. The tokens provided will represent a participant ’s share of the portfolio. Thirty percent of the total amount contributed during the offering will go directly towards buying the underlying index cryptocurrencies.

Blockchain Investments issues tokens built on a profit-sharing smart contract. The company is proud to introduce the Token-As-Fund business model, which allows investors to subscribe to the fund’s income stream. To monitor the current reserves of the fund and the fund’s value, a self-certification system is included so shareholders can monitor their investment at any time. Performing daily self-certification of funds in conjunction with monthly external audits will ensure transparency and trust between BLV fund managers and shareholders. Blockchain Investments offers multiple open-end investment funds also known as Digital Asset Arrays or Bespoke Blockpools.

Blockchain Investments helps its clients create passive income from Blockvest Nvestnodes. Nvestnodes are similar to bitcoin mining but are a much more efficient use of the network and are much less complex. Nvestnodes have some crucial additional functionalities which give them more utility than Bitcoin. Utility is a primary driver of value for cryptocurrencies. Blockvest connects collateral holders with people who require low volatility, which creates an incentive-based market for stability. Collateral holders are rewarded when users transact in the stablecoin, compensating them for staking the system. We enable individual asset coins to be bundled and listed as Digital Asset Arrays similar to ETFs, Futures Contracts and Forex Currency Pairs. This will allow investors to diversify their Cryptocurrency portfolio with traditional financial products written on smart contracts, recorded on the Blockchain and settled in Cryptocurrency. The Blockvest Project is starting with Blockvest Nvestnodes but we anticipate a future of Bitcoin Nvestnodes, Ethereum Nvestnodes, BlockVest Blockchain Derivatives and more — all of which can be listed on cryptocurrency exchanges around the world and be traded globally.

PRE-IPO

Testing The Waters Phase

JOIN NOW AND GET 20% BONUS “BLV TOKENS”

$1 BLV = $1 USD

BLV Tokens Sold:

- 18%

Nvestnode Wallet

Blockvest Staking

Generate Nvestnode Passive Income

Client-Side Encryption

Fully Transparent

Multi-Asset Support

Yield Stable Coin

Global Trading

All assets in one place

Tokenized profit-sharing

24/7 trading

Fully Transparent

Decentralized exchange

BlockVest Blockchain Derivatives

100 million BlockVest tokens

The next generation of advanced solutions for global cryptocurrency investing

Why Use BlockVest?

BlockVest provides the benefits of the world’s top cryptocurrencies in one platform

Blockvest ~ Bitcoin

Blockvest ~ Bitcoin

Blockvest ~ Ethereum

Blockvest ~ Ethereum

Blockvest ~ Dash

Blockvest ~ Dash

Blockvest ~Litecoin

Blockvest ~ Litecoin

Blockvest ~ Tether

Blockvest ~ Tether

Blockvest ~ Mutual Fund

Blockvest ~ Mutual Fund

Key Dates – 2018

The next generation of advanced solutions for global money transaction

• Release of white paper and technical plan

Release of white paper and technical plan description

• Private Sale

50% Bonus for token purchases during the private sale

•NFA Swap and Forex Firm Pending

• SEC Reg A+ Securities Offering Approved

• Pre-IPO Testing The Waters Phase

• BlockVest DEX Launches Demo MVP Atomic Swap Platform

• Full launch of the BlockVest Decentralized Exchange and launch of BlockVest Platform, Wallet, and Nvestnode

• Global ICO

The BlockVest Token ICO goes Live!

• Global IPO

The highly anticipated launch of the BlockVest Global Initial Public Offering

LATEST NEWS

BLOCKVEST DEX LAUNCHES ITS DEMO MVP ATOMIC SWAP PLATFORM

BLOCKVEST DEX LAUNCHES ITS DEMO MVP ATOMIC SWAP PLATFORM BlockVest Announces Its Official Launch Date of Atomic Swap version of its Crypto Exchange Across Multiple Events Thursday 2nd of August 2018, Manhattan, New York — BlockVest’s Founder Reginald Ringgold today...

Moderating the Insurance 2.0 panel at Fintech Week in NYC.

Moderating the Insurance 2.0 panel at Fintech Week in NYC. /...

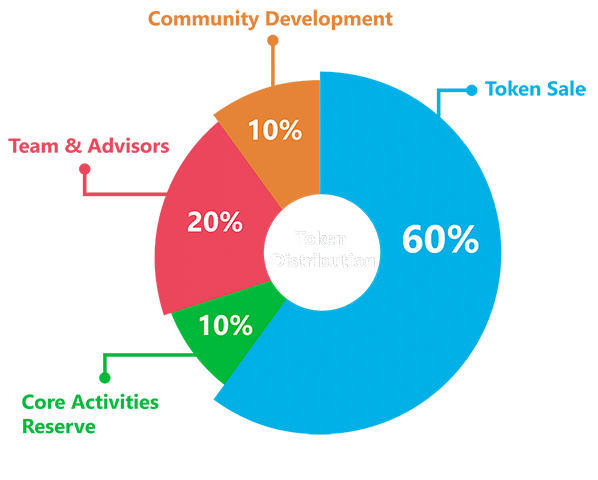

BlockVest Distribution

BLV’s 100 million tokens are divided into two portions. The first portion of 50 million tokens will be distributed proportionally to supporters of BlockVest during the crowdfunding. This portion is yet to be distributed.

Any Questions?

Read the FAQ

1. What is Blockvest?

Blockvest Nvestnodes generate passive income through asset backed profit sharing smart contracts. At its core, Blockvest is a Decentralized Blockchain Based Assets Exchange as well as a cryptocurrency index fund, which is a closed-cap, tokenized cryptocurrency portfolio that autonomously tracks the top 30 cryptocurrencies. We call it the Blockvest30 Index. The fund provides an easy way for the average investor to buy multiple cryptocurrencies all at once, without doing all the research.

2. What problem are we solving?

3. How does it work?

Blockvest uses this system to reward those who supply stability while charging those who demand stability. The end result is a Decentralized Exchange and balanced stablecoin ecosystem. Blockvest achieved this structure using two linked tokens – Blockvest (BLV) and Yield (YLD).

4. When will Bonus airdrops take place and what are the conditions for participation?

5. What coins are accepted on Blockvest for exchange?

6. How is the fund structured?

Under the helpful eye of the CFTC and NFA, we look forward to providing certain qualified investors access to this evolving market”. The Fund will be managed by Blockchain Investment Group, LLP, a commodity pool operator registered with the Commodity Futures Trading Commission and a member of the National Futures Association:

7. How is Blockvest compliant with SEC laws?

In the United States, BLV Tokens will be offered and sold only to accredited investors as such term is defined in Rule 501(a) of Regulation D pursuant to the exemption provided by Section 4(A)(2) of the Securities Act and Rule 506(c) of Regulation D promulgated thereunder.

You can view Blockvest’s Form D here.

8. What is the Distribution Mechanism?

Digidends are paid out in BLV to Investornode account holders based on a class A Equity Share structure pursuant to section 506(c)

9. What are Digidends?

10. What will be done with unsold tokens from the Pre-IPO and Global IPO?

BLV Tokens Sold

- 18%